Poverty charges interest: wealth inequality is more problematic than you think

March 5, 2019

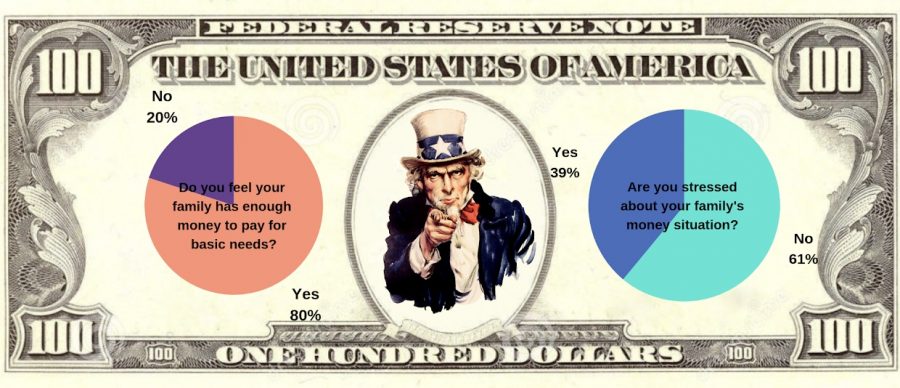

In a Southerner conducted survey, 20% of students surveyed said that they feel like their family doesn’t have enough money to pay for basic needs. 39% said they often worry about their family’s money situation. However, young people shouldn’t have to worry about money at all — it takes away from their chances of being able to be successful later in life and exacerbates cycles of wealth inequality.

When asked about whether or not they believe in the “American Dream” of rags to riches, 77% of the nation said “no,” according to Pew Charitable Trusts. Not only are people rejecting the notion of the “American Dream” but some are coming to the conclusion that it was a myth to begin with. And from a logical perspective, looking at the population of nearly 80% of America that lives paycheck to paycheck — according to CNBC — this seems all too true.

According to the NCCP, nearly 40 percent of young adults belong to low-income families. Many South students themselves are in this situation. According to MPS reports and data, 54.6% of South students qualified for free and reduced lunch in 2018. In a Southerner-conducted survey, it was found that 39% of students surveyed are stressed about their family’s money situation, and 20% of students feel that their family does not have enough money to pay for basic needs.

“My brother has to pay for his son,” says senior Vidal Quevedo-Moco. “My dad has a business he’s trying to uphold, my mom can’t get that much work because her physical health isn’t that good. I’ve been sick for like three weeks, but I can’t go to a clinic because we don’t know what our insurance is. And then I can’t go to work, so I can’t pay for things. Right now, most of my money is going towards the household.”

For students who have to deal with the responsibility of supporting their family, success in the school environment is not particularly easy. It’s also common knowledge that families with lower incomes have fewer resources to help their children succeed in school.

The vicious cycle of perpetual inequality begins here. The economic class a person is raised in will greatly shape the economic class they will end up falling into.

In order to prepare children to succeed in life, it’s up to parents to provide all of the resources for their children; to invest time, money, and work into raising them so that they will be well-equipped to deal with all of the troubles of life.

But when parents are not able to do this, it’s much harder for children to develop strong goals to prepare for their future, and thus the cycle continues. To sum it up, how you perform is tied to how your caretakers performed, and how their caretakers performed, and so on.

Society might be able to tolerate some levels of inequality if it wasn’t so important to have money. Many don’t quite understand how resource demanding life is. Basic necessities like food, housing, monthly bills like heating, water electricity, and transportation will almost certainly cost upwards of a thousand dollars a month. Yet the federal minimum wage is still $7.25 per hour. If monthly expenses are exactly $2000, this requires nearly 70 hours of work per week at the minimum wage level. How is a person supposed to raise their economic status if they are already working that much and can barely pay to get food on the table?

And that two thousand dollars a month is only for people who don’t want to have luxuries, education, a house, savings, kids, or want to retire. Two thousand dollars is what it costs to exist in the most bare-bones sense of the word.

Many people think that being born into wealth is merely a step up, but that’s an oversimplification. The effects of having wealth grow exponentially. Those who have many assets can use their material advantage to ensure that they will continue having a material advantage, or that their advantage will grow.

Poverty also works in a similar, worse way. The strain of worrying about money and resources, plus the hard work that goes into working for a low wage has a very negative impact on a person’s mindset. Economic uncertainty can quickly turn into a nightmare for those unlucky enough to have to choose between medicine or food, student loans or electricity.

Social studies teacher Robert Panning-Miller explained, “Poverty is also a relative concept. Poverty in this society contributes to issues from physical to mental health in terms of people’s well being, people in poverty have shorter life expectancies, people in poverty have less opportunities in terms of academics, so it affects your whole life.”

For those who still quip “well what about the American Dream?” I would like to point out that, although this “Dream” may drive some people forward, it’s ultimately unobtainable for most. The real American Dream is a tool, a piece of propaganda, designed to create hope. As long as that hope keeps people going, and complacent within the system, people are exploitable.

Now sure, there are some success stories about people who worked their way from poverty to wealth and comfort, but if we rely on anecdotal stories to back up the legitimacy of our society’s governing motto, we are doing something wrong.

Truly, there is no real success in this model. People who have go from the bottom to the top either exploited other people’s labor, unfairly gamed the system, or will tell you about how laborious and draining it is to, say, start and manage a company, or move up the ranks in an existing one. For some reason, society doesn’t really point out just how absurd this is as a goal. At the same time, our system depends on many people spending decades of their lives toiling away so that they may exist, and their labor is then exploited for the benefit of the rich.

The subject of a 70% marginal tax rate became a large part of the debate when Alexandria Ocasio Cortez (AOC) brought it up. A marginal tax rate means that the amount you are taxed goes up gradually as your income goes up. Therefore, only those who make over $10 million would have to pay 70% in taxes.

AOC was quick to point out that this idea, however, was nothing revolutionary. Marginal tax rates met those levels and sometimes exceeded them in the 60s and 50s, a time that many consider America’s economic “golden age” of America economically. This idea was not anything remotely radical then or now. Yet because of the scale of control the American right and the rich oppressor class has over media, they made it seem like past policies were actually radical.

Those who are concerned about this problem, yet who also believe in the capitalist, “American Dream” model of society, have some tough things to take into consideration.